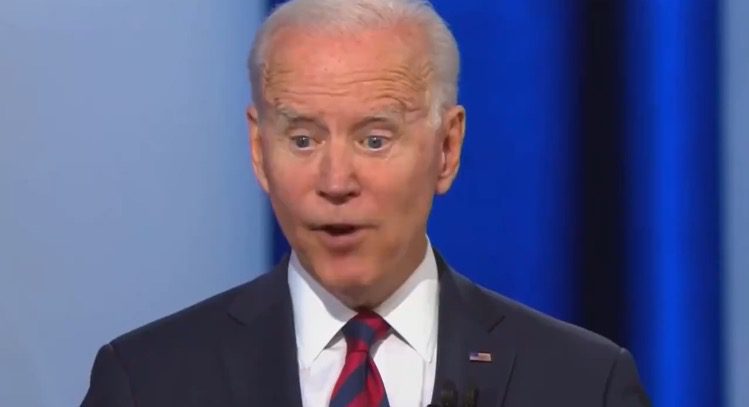

Joe Biden Could Owe as Much as $500,000 in Back Taxes For Improperly Using “S Corporations” to Avoid Paying Medicare Taxes on Speaking Fees

For all the noise about Trump’s taxes, it looks like “middle class” Joe Biden, AKA, “The Big Guy,” is the one who improperly avoided paying taxes before being installed in January.

According to a new report, multi-millionaire Joe Biden could owe as much as $500,000 in back taxes on speaking fees and book sales in 2017 and 2018.

“Joe Biden wants to raise taxes by $2.1 trillion while claiming the rich need to pay their ‘fair share.’ But in 2017, multi-millionaire Joe Biden skirted his payroll taxes — the very taxes that fund Medicare and Obamacare,” said Rep. Jim Banks (R-IN), chairman of the conservative Republican Study Committee.

“According to the criteria CRS provided to my office, he owes the IRS and the American people hundreds of thousands of dollars in back taxes,” Banks said. “Every American should know about Joe Biden’s tax hypocrisy.”

The New York Post reported:

Republicans say a new non-partisan report indicates President Joe Biden improperly avoided paying Medicare taxes before he took office — raising eyebrows and the possibility that he owes the IRS as much as $500,000 in back taxes.

Biden is leading a Democratic push for a $3.5 trillion bill to subsidize childcare, education and health care by targeting tax avoidance and raising tax rates on higher incomes so the rich “pay their fair share.”

A House Ways and Means Committee draft of the bill would end the accounting trick apparently exploited by Biden and boost IRS funding for audits — but the new report, drafted by the Congressional Research Service and provided to The Post, suggests Biden owes taxes under current rules, according to the congressman who requested it.

Banks said the report shows Biden improperly used “S corporations” to avoid paying Medicare tax on speaking fees and book sales in 2017 and 2018.

Biden and first lady Jill Biden routed more than $13 million through S corporations and counted less than $800,000 of it as salary eligible for the Medicare tax — exempting the rest from what would have been a 3.8 percent rate, the Wall Street Journal reported.

The CRS report doesn’t name Biden but analyzes cases in which the IRS won a judgment against taxpayers who paid themselves suspiciously low salaries from S corporations and counted most of the revenue as “distributions” exempt from the Medicare tax.

Hunter Biden also doesn’t pay his taxes.

Recall, Hunter Biden was hit with a huge tax lien in July 2020 over delinquent state income taxes and he magically “resolved” it in 6 days even though he has no income.

A $450,000 tax lien was filed against Hunter in July 2020 and within 6 days, the unemployed “broke” father of 5 was able to “resolve” it within 6 days.

It is unclear if Hunter Biden actually paid off the tax lien.

Hunter Biden must have received special treatment from the government because it could take several months or even years to clear up or negotiate a payment plan for such a large tax lien.

Tax cheat Joe Biden won’t be held accountable either in this two-tiered justice system.

No comments